Players often think the biggest difference between betting sites is odds or bonuses. In reality, the market status matters just as much: it shapes what rules the operator must follow, what help you can get if something goes wrong, and how safe your deposits really are. If you’ve ever seen a promo link to Betwinner APK or any other sportsbook app, you’ve already brushed up against the gray-zone question: “Is this brand licensed where I live, or is it operating from somewhere else?”

1) White markets vs. gray markets: what the labels mean in practice

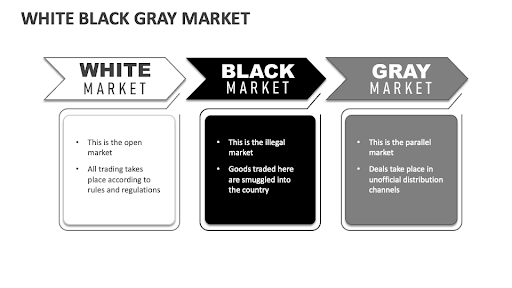

A “white market” is a jurisdiction where online betting/casino activity is explicitly regulated and licensed, with clear conditions for operators and defined player protections. A “gray market” usually means the operator is licensed somewhere, but not licensed (or not clearly permitted) in the player’s location—often relying on cross-border access, marketing loopholes, or enforcement gaps. The key point is not the brand’s popularity; it’s whether the operator is accountable to the regulator that governs your residence.

Below is a direct comparison of what typically changes for players and affiliates when a platform is fully regulated locally versus operating in a gray position.

| Topic | White market (locally licensed) | Gray market (not locally licensed / unclear permission) |

| Legal footing | Clear rules for who can offer gambling, how, and to whom | Rules may be ambiguous for players; operators often rely on offshore licensing |

| Player disputes | Formal complaint path: operator process → regulator/ADR in many regimes | Disputes may stop at operator support; regulator may not accept your case |

| Compliance obligations | Strong KYC/AML, responsible gambling tools, reporting standards | Standards vary; enforcement is often weaker or remote from player |

| Enforcement risk | Operator faces meaningful penalties if it breaks local rules | Operator may be harder to sanction; domains/payment routes can change quickly |

| Marketing/affiliates | Ads and promotions are regulated; disclosures often required | Greater risk of takedowns, payment blocks, and contract instability |

| Taxes & reporting | May include withholding/reporting obligations depending on country/state | Player tax obligations can still exist, but paperwork support is inconsistent |

Where this leaves you: “white vs. gray” is really about accountability. In a white market, the operator’s license can be suspended, fines can be issued, and dispute channels tend to be structured. In a gray market, you might still get paid and have a smooth experience—until you don’t. If a withdrawal is delayed, an account is closed, or terms are applied aggressively, your leverage is usually lower because the regulator that matters to you may not supervise that operator.

2) Deposit protection: what you actually have when money goes in

Deposit protection isn’t just about “will I win?” It’s about what happens if a payment fails, a wallet is flagged, a bank rejects a merchant category, or an operator freezes funds during verification. In regulated settings, there are often standards around safer payments, identity checks, and complaint handling. In gray situations, payment chains can be more fragile: processors change, banking routes get blocked, and the operator may push alternatives that reduce chargeback rights (for example, certain crypto rails or voucher-style methods).

Use the checklist below before depositing—especially if you’re unsure whether the site is locally licensed.

- Confirm local licensing, not just “a license.” A logo in the footer is not the same as a license that covers your country/state. Look for a license number and the regulator name you can independently verify.

- Check the dispute path before you need it. Is there a published complaints procedure? Is there an independent ADR/mediator option? Are response timeframes stated?

- Prefer payment methods with consumer protection. Card payments and major wallet providers often come with dispute frameworks. Some transfer types and many crypto transactions are effectively final once sent.

- Read the “source of funds” and KYC triggers. Many freezes happen after a big win, a sudden deposit pattern change, or mismatched ID details. Know what documents may be requested and what timelines are described.

- Look for clear withdrawal terms. Watch for vague wording around “security checks,” “enhanced verification,” “management discretion,” or limits that can be changed without notice.

- Avoid mixing identities and instruments. Depositing from one name and withdrawing to another, or using shared family cards, is a common reason withdrawals stall.

- Track every transaction. Save receipts, transaction IDs, screenshots of cashier pages, and support tickets. If something goes wrong, your case depends on records, not memory.

- Be cautious with bonus-linked deposits. Wagering rules can tie up balances. If you want liquidity, deposit without bonuses and keep play simple.

- Test small before going large. A small deposit + a small withdrawal is a practical stress test of the payment flow and verification process.

Bottom line: deposit protection is strongest when your operator is supervised by the same legal system you live under and when you use payment rails that include chargeback or dispute rights. In gray markets, your funds can still move smoothly, yet the risk profile shifts: fewer levers to pull if support stalls, more reliance on offshore policies, and more exposure to payment interruptions that are outside your control. If you treat deposits like you would any online purchase—verifying accountability, testing flows, and keeping strong records—you reduce the chance that a simple cashier action turns into a long and expensive headache.